- Product

- SEO Content Editor

- SEO Content Strategy

- Content Optimization

- Content Briefs

- AI Assisted Writing

- Keywords Clustering

Preview a demo walkthrough

Outranking the competition with our cutting-edge SEO strategies.

- Pricing

- Resources

- Sign In

- Get Started

Table of Contents

In the next 10 years, the number of insurance agents in the world is expected to grow by 6%. So you can’t expect your insurance services website to perform well if you don’t go the extra mile. To outrank all the other insurance agents, you need a strong online presence.

The best way to do that is to get your website ranking on the first page of search engine ranking pages (SERPs). But to get there, you need an excellently planned SEO content strategy so that people love your content.

For all the insurance agents and agencies out there, we’re giving out some SEO best practices to reach as many people as possible and get your agency to the top.

Table of Contents

Why Does SEO Matter

The insurance company landscape is very competitive, so it gets challenging for insurance agents to attract and retain customers.

But thanks to the evolution of digital marketing, insurance agents and agencies can now harness the power of SEO for this purpose. SEO, or search engine optimization, is a crucial strategy to improve your online visibility and attract more organic traffic to your website.

Ranking on SERPs means your insurance company’s page will appear in the results when someone searches for the right keywords. Here’s why this is good news for your insurance agency:

- SEO increases the SERPs rankings of your insurance agency.

- SEO improves the organic traffic to your website.

- SEO helps you convert prospects into customers.

- SEO is a cost-effective method compared to pay-per-click advertising.

13 Steps To Better SEO For Your Insurance Agency

Step 1: Create Website Architecture And Define Your Core Service Areas

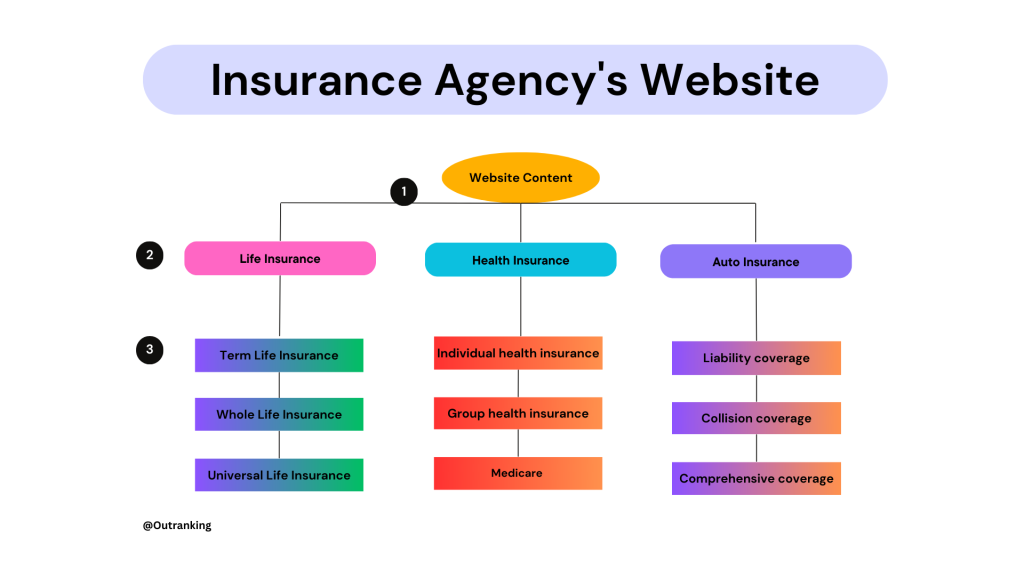

To become the favorite of SEO algorithms, the first step is to understand your insurance agency’s core areas. This means you should identify the key areas that connect most with your agency’s core offerings.

By doing this, you can structure your agency’s website in a simple format before building it, which makes website navigation easier. This also helps with keyword research later on.

To break down your insurance agency’s website architecture into core offerings and its extended list of sub-areas, you need to identify the agency’s core service areas. These may include life insurance, health insurance, auto insurance, home insurance, and business insurance.

For each of these areas, you can then create an extended list of sub-areas.

Here’s a table to show you how an insurance agency’s website can be broken down:

| Core Service Areas | Extended List of Sub-Areas |

| Life Insurance | 1. Term life insurance 2. Whole life insurance 3. Universal life insurance 4. Variable life insurance 5. Survivorship life insurance |

| Health Insurance | 1. Individual health insurance 2. Group health insurance 3. Medicare 4. Medicaid 5. Short-term health insurance |

| Auto Insurance | 1. Liability coverage 2. Collision coverage 3. Comprehensive coverage 4. Personal injury protection 5. Uninsured/underinsured motorist coverage |

Breaking down these core offerings and sub-areas will help you understand which areas are most important for your insurance agency. From there, you can develop a plan for keyword research and content creation, so you can put out content that’s relevant to your target audience. By doing this, you can improve your agency’s SEO and attract more traffic to your website.

Step 2: Perform Keyword Research

For your agency’s keyword research process, you should remember these three key things:

- Gather the list of keywords in each of the core areas of your website

- Repeat the keyword research step for each core area you have

- Perform keyword research for each sub-area under each core offering

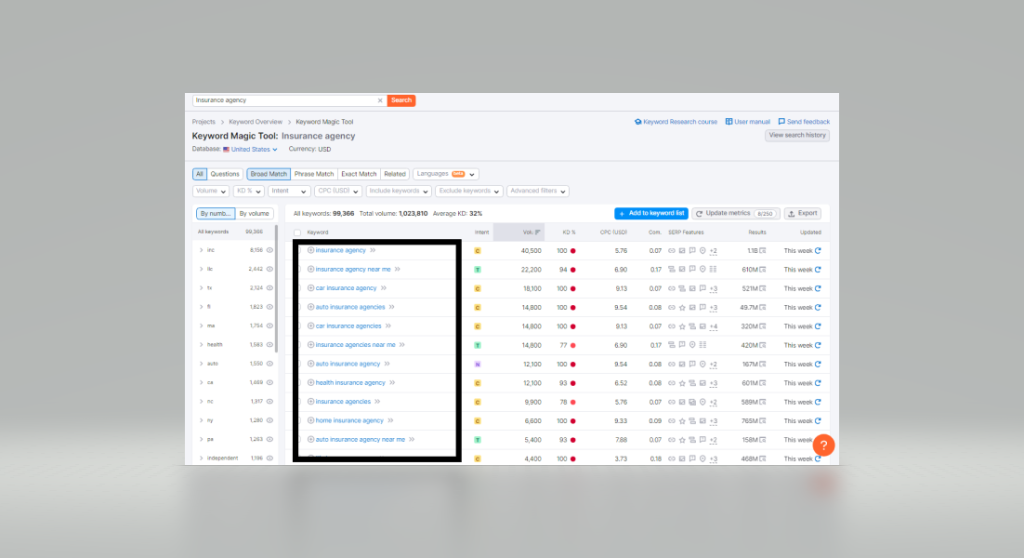

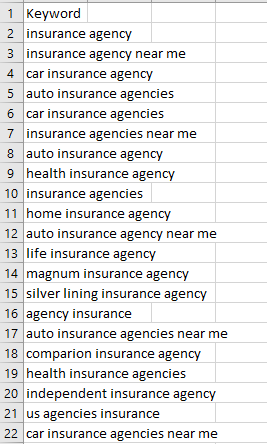

To perform keyword research for an insurance agency website, we can use keyword research tools like Semrush or Outranking.

Method 1: Semrush

- Go to Semrush and enter “insurance agency” as the main keyword

- Select the country and language you want to target

- Click on “Keyword Magic Tool” and wait for the results to load

4. Use filters to exclude outdated or irrelevant words

5. Download the CSV file with the desired data

6. Repeat these steps for each core area and its sub-area of focus

7. Combine all files together for easier management

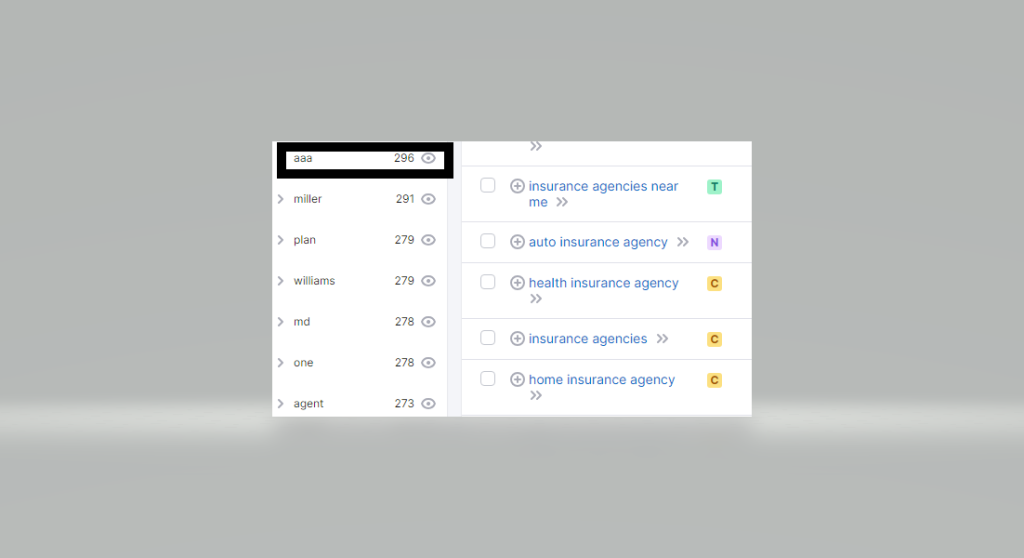

Method 2: Outranking

Alternatively, you can use Outranking to gather keywords and analyze them. Here are the steps:

- Go to Outranking and select “Insurance” as the main category

- Select “Insurance Agent” as the subcategory

- Click on “Generate Keywords” and wait for keyword ideas to generate

- Use the cluster analysis to refine the keywords

- Export the list of refined keyword phrases

- Repeat these steps for each core offering area and sub-area of focus

Once you collect the keywords for each sub-group in a core service area, you can move to the next step of keyword analysis. This involves analyzing the search volume, competition, and relevance of each keyword to determine which ones to target in your content strategy.

By following these steps, you can create a comprehensive keyword strategy that will help drive traffic to your insurance agency website.

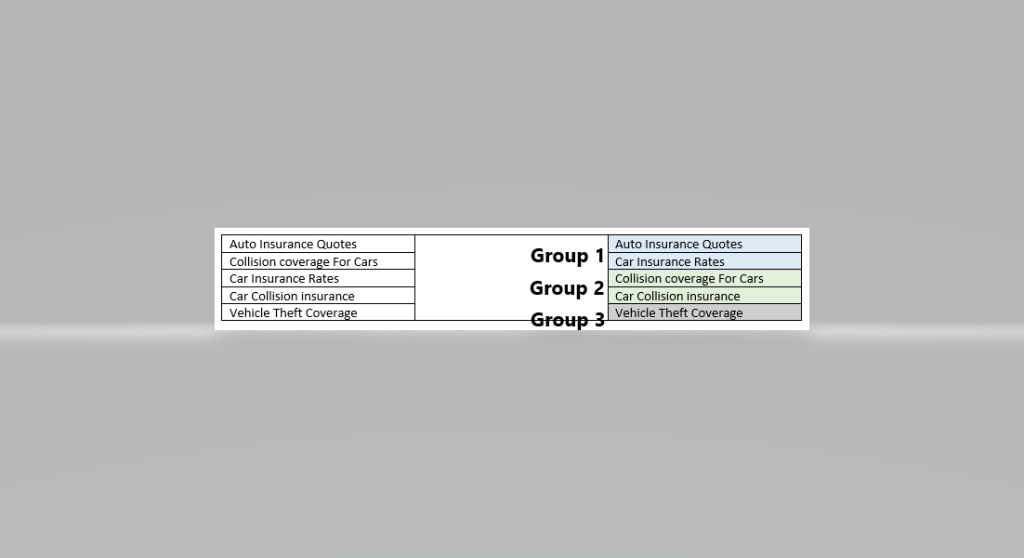

Step 3: Perform Keyword Clustering

Keyword clustering basically means grouping similar keywords into clusters based on their semantic terms and user intent groups. By clustering relevant keywords, you can create a plan for new content on your insurance agency website, and target specific search intent and groups of keywords. This will increase your chances of ranking higher in SERPs.

For example, an insurance agency can cluster keywords related to car insurance, home insurance, life insurance, and health insurance. Within each cluster, you can further group similar variations of keywords, such as “auto insurance quotes,” “car insurance rates,” and “vehicle insurance coverage” in the car insurance cluster. Similarly, for home insurance, you can use keywords like “homeowner’s insurance policies” and “Homeowners insurance”.

Next up, you should pick a primary keyword for each cluster. To do that, consider:

- Your ability to create better content than your competitors for certain keywords

- The number of backlinks your competitors have

- The knowledge gap or underserved area in the intent

- Your topical authority

- The common SERP competitors

When you carefully choose primary keywords for your clusters, you can help your agency capitalize on opportunities relevant to the user intent and avoid keywords that are difficult to rank for.

It’s important to hire someone who knows what they are doing if your agency doesn’t have an in-house SEO/marketing team. SEO and keyword clustering require expertise and experience to be effective. A professional can help your agency create a comprehensive SEO strategy, analyze the competition, and use a keyword clustering tool like Outranking to group and analyze keywords effectively.

Step 4: Create a Content Calendar For Your Insurance Agency

To prioritize keywords for creating and optimizing content for an insurance agent and agency website, the first step is to create a list of primary keywords and groups that are relevant to the insurance industry.

Once you have your list, the next step is to prioritize and volume keywords based on the importance of each keyword in driving traffic and conversions to your website.

Outranking can help with this prioritization process by providing a keyword planner that allows you to map out a plan and schedule for your content. Outranking also allows you to set priorities for your keywords: High, Medium, and Low.

Here’s a quick guide to help you prioritize your keywords for your insurance agency website:

| Priority | Keywords Containing | Why |

| High | Insurance policies, Coverage options, Claims process | These keywords are essential to your business and should be given the highest priority. They will help define you as a thought leader in the insurance industry and support your important pages for the flow of information |

| Medium | Insurance quotes, Discounts, Reviews | These keywords can help place your insurance agency among many competitors and attract potential customers who are looking for the best deals and services |

| Low | Insurance education, Industry news, Insurance history | These keywords can define you as a thought leader in the insurance industry and support your important pages for the flow of information, but they are not as critical as the high and medium priority keywords |

Step 5: Establish a Content Production Process

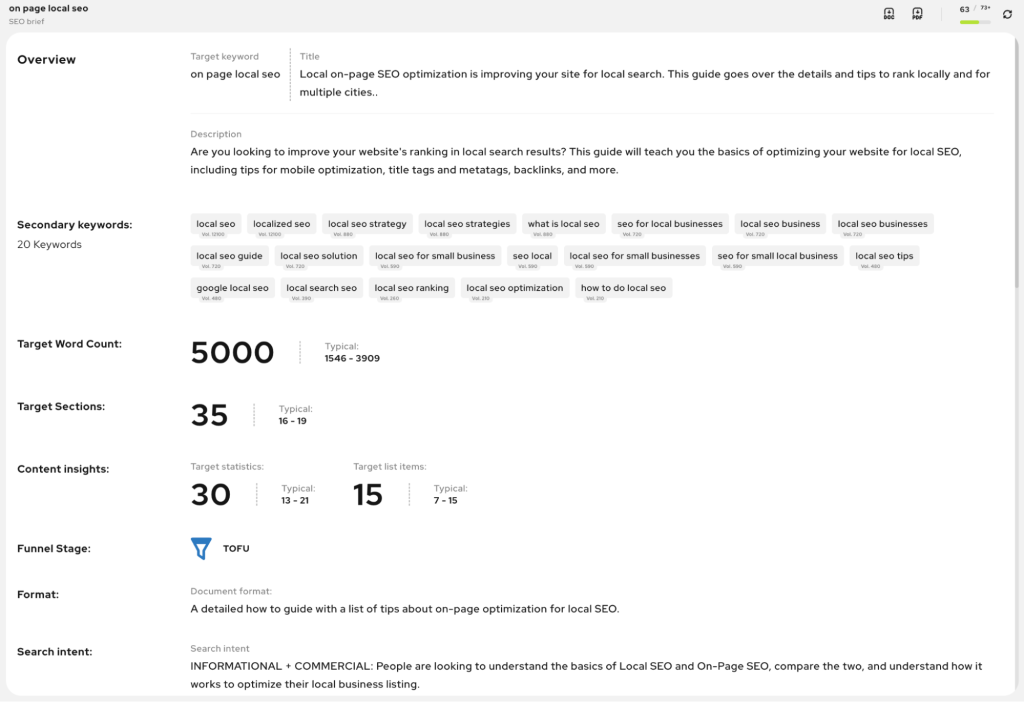

You can’t shortcut your way to good SEO. So having a proper content production process is necessary. To do that, you should establish a well-defined process in place and create detailed SOPs or content briefs. Here are two tips to help you create a thorough content creation and optimization process for your insurance agency:

1. Create Solid Content Briefs

A content brief is a document that outlines the key elements of your content, including the target audience, keywords, tone, and format. By creating a solid SEO content brief, you can ensure your content is optimized for search engines and resonates with your target audience. Make sure to include specific details and guidelines for your writers to follow.

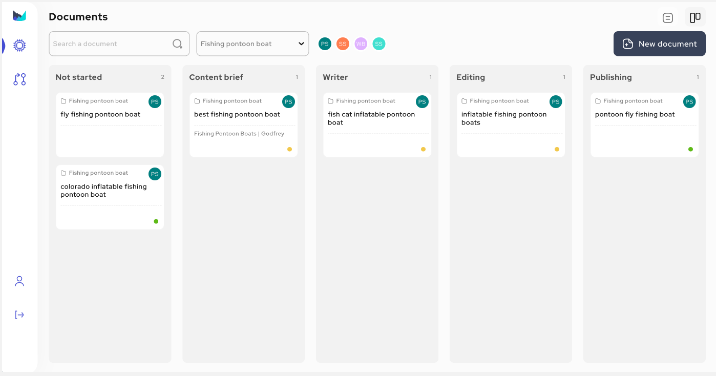

2. Set up a Workflow for the Tasks

A workflow is a series of steps that need to be completed to achieve a specific goal. By setting up a workflow for your SEO tasks, you can ensure everyone on your team is on the same page and that tasks are completed efficiently.

Use a project management tool like Outranking to define and assign tasks, set deadlines, and track progress. Outranking has a predefined workflow status and a Kanban view that allows you to keep track of every document with a customized workflow. Additionally, Outranking’s integrated tool can help you create content briefs and optimize your content for search engines.

Step 6: Create SEO-Optimized Content For Your Insurance Agency Website

Creating SEO-optimized content for each service page and blog is crucial for insurance agents and agencies to ensure they’re spending money on content that will yield results.

Optimizing your content also helps you answer users’ queries, attract more organic traffic, and improve search engine rankings. Avoid adding complex industry jargon to ensure your content remains user-friendly and informational.

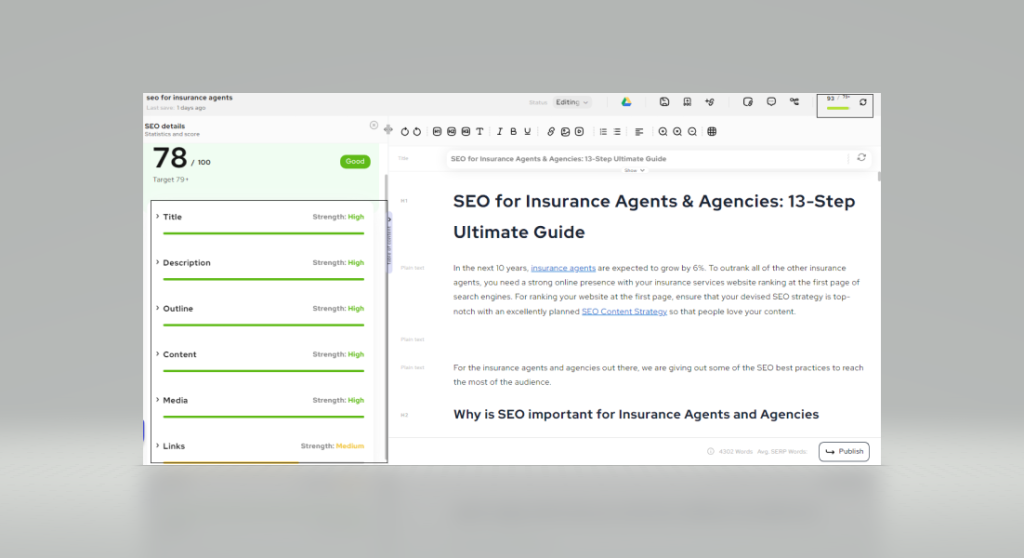

Outranking’s AI SEO quality content writing and optimization tool can help busy insurance agents with limited time to write and optimize their pages to ensure the highest possible organic exposure. With its real-time scoring of on-page SEO optimization benchmarks, Outranking can help your agency create content that ranks well each time.

Outranking helps you optimize your title tags and meta description, outlines and headings, word count, common NLP terms, unique entities, lists and tables, statistics, media, internal and external links, and featured snippets.

Step 7: Optimize Internal Linking

Optimizing existing pages with better internal linking can help improve the overall traffic of your agency’s website by borrowing the authority of pages that are already ranking and transferring it to the page that needs to rank for more keywords.

By analyzing the positions of existing pages, website owners can find pages that rank between 1 and 10 (top 4-14 positions) and have some authority. These are the pages that should be optimized for better internal linking.

For an insurance agents and agencies website, you should look to optimize pages that have keywords related to their services such as “insurance policies,” “coverage options,” “claims process,” and “insurance quotes.” These pages should rank between 1 and 10 to have some authority and potential for increasing traffic.

Outranking can connect to Google Search Console and identify pages that are already ranking and have some authority. It can then show internal linking opportunities by suggesting pages that can link to the identified page using specific anchor text. By following these suggestions and optimizing internal linking, website owners can improve their website’s performance and increase traffic.

Step 8: Get The Most Backlinks And Local Citations

Acquiring local citations and backlinks is crucial for the local SEO of insurance agents and agencies websites. Local citations are mentions of a business’s name, address, and phone number (NAP) on other websites, while backlinks are links from other websites to the business’s website.

For insurance businesses, acquiring local citations can help with local SEO in several ways. First, it can help you rank higher for local search queries related to insurance. According to a survey by Moz, citations are the fifth most important ranking signal for local queries. Second, it can help you get listed on business directories and other websites that dominate search results for local queries. This is important because people often turn to these sites to find local businesses.

Citations come in two types: structured and unstructured. Structured citations list your business’s NAP information in a consistent format, while unstructured citations are contextual mentions of your business. Both types of citations are important for local SEO.

To build citations, insurance businesses should follow these four steps:

- Get listed with the ‘big three’ data aggregators: Acquiring citations from data aggregators is important because they distribute business information to a wide range of directories and websites. The ‘big three’ data aggregators are Data Axle, Localeze, and Acxiom.

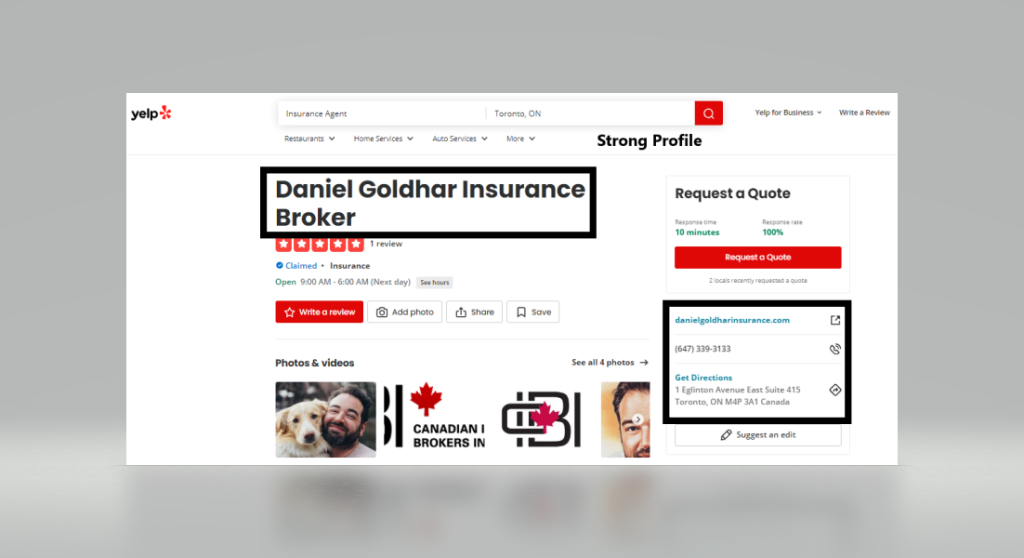

- Submit to other core sites: It’s important to get your insurance agency listed on Google My Business, Bing Places, and Yelp.

- Submit to popular industry and local sites: Submit your information to popular industry and local sites such as the Insurance Journal, Insurance Business America, and local chambers of commerce.

- Pursue unstructured citations: Reach out to influencers on journalists to get your insurance agency mentioned in blog posts, forums, or press mentions.

Take a look at this table of data aggregators and websites for citations:

| Data Aggregator | Websites to Get Citations From |

| Infogroup | Yellow Pages, Superpages, Citysearch |

| Localeze | Yahoo Local, Bing Local, Yelp |

| Acxiom | Facebook, Bar List Publishing, Insured Mine |

Step 9: Optimize Page Speed and Website Experience

It’s crucial for insurance agents and agencies to optimize their website’s page speed and overall user experience for better rankings in 2023. This will not only improve their website’s visibility but also attract potential customers who are looking for insurance services online.

To quickly optimize page speed and website experience, insurance agents and agencies can use better and lighter themes like the insurance agent theme available on CodeCanyon and NitroPack-like WordPress plugins. These plugins help in compressing images, caching, and optimizing website code for faster loading times.

You can also optimize your XML sitemap so search engine bots discover all the content you’ve included on your website, like what services you provide, the insurance products you offer, your blog content, and “contact us” information.

Step 10: Track Rankings Using Google Search Console

For an insurance agent or agency, connecting to Google Search Console and tracking website ranking data is crucial for improving organic traffic and staying ahead of the competition. By analyzing the ranking data, insurance agents can optimize their existing content, create fresh content, and improve underperforming pages to attract potential customers and increase their online visibility.

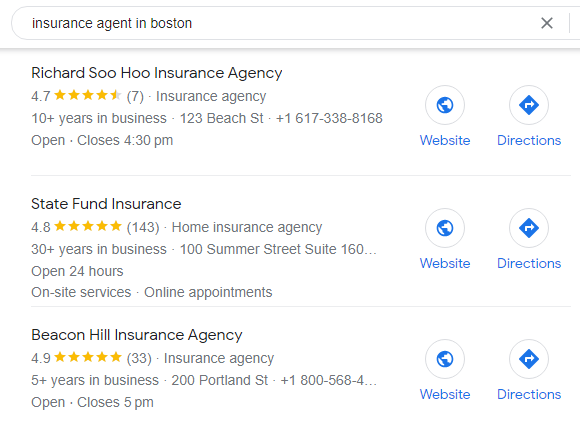

Step 11: Optimize And Leverage Google Business Profile

A Google Business Account is a free service that allows you to provide more information about your insurance agency when it appears in search results. Here are some expert tips to improve your insurance agency’s listing:

Expert tips to improve business listings for insurance agents and agencies:

- Claim and verify your Google My Business Account to ensure accurate information is displayed in search results

- Add detailed and accurate information about your agency, including business hours, phone number, website URLs, email address, FAQs, and services offered

- Use relevant keywords in your business description and choose the most appropriate category for your business

- Add photos and videos of your agency, including staff photos, office interior and exterior, and promotional videos

- Encourage clients to leave reviews on your Google My Business profile to improve your local search ranking and credibility

- Use Google Posts to share updates, promotions, and news about your agency

Monitor and respond to customer reviews and questions to show your commitment to customer service and improve your online reputation

Step 12: Invest in the Right Tools to Set up the Structure, Create Processes, and Optimize Content

Investing in the right tools like Outranking is crucial for insurance agents and agencies to succeed with SEO. Outranking is an all-in-one SEO platform that provides keyword research, content optimization, and performance tracking.

It offers keyword suggestions, content optimization recommendations, and performance metrics to help optimize pages efficiently. By utilizing such tools, you can streamline your insurance agency’s SEO content strategy, including on-page optimization, and achieve your online goals.

However, having the right team behind these efforts is equally important. Clear communication and collaboration between team members are essential for achieving goals and producing high-quality content.

Establishing team alignment by setting clear goals, assigning specific responsibilities, holding team members accountable for their assigned tasks, meeting deadlines, and producing high-quality work is crucial.

Regular check-ins and progress updates through project management tools like Trello or Asana can keep everyone on track to meet project milestones as planned. Good team alignment can increase efficiency, produce better-quality content, and create a more cohesive team, resulting in a successful SEO content strategy.

Step 13: Focus on the Ultimate Goal — Leads and Conversions

Most websites focus on organic traffic because it’s a cost-effective way to attract potential clients to their site. However, it’s important to note that not all traffic is created equal.

For example, a short-tailed keyword like “insurance” may bring in a lot of traffic. But it won’t really get your website the traffic it needs. It might simply be someone searching for information about insurance, which won’t matter if your goal is to get customers.

On the other hand, a more specific keyword like “auto insurance quotes” may attract fewer visitors, but the audience will be more targeted and likely to convert into leads and eventually new clients.

It’s not about how much traffic you get but about the quality of the traffic you get. The important thing is to convert this traffic into paying customers.

How to Evaluate an Agency to Help with the SEO of Your Insurance Agency

Having an agency to assist you on the journey to better SEO is great — on one condition. You have to choose it carefully. Below we’ve highlighted some key areas that you should examine whenever you’re thinking of hiring an SEO agency.

Expertise, Reviews, and Results

When evaluating an agency to help with SEO for your insurance agents and agency’s websites, it’s important to look for expertise, reviews, and results:

- Look for an agency with experience in the insurance industry. They will have a better understanding of the competitive landscape and be more creative in their approach to strategy design. Ask for examples of their work with insurance clients.

- Check their reviews and testimonials. Look for agencies with a track record of delivering results for their clients. Ask for references and contact them to get their feedback.

- Evaluate their results. Look for agencies that can provide statistics and data on their results. Ask for case studies and examples of how they have helped other insurance clients improve their search engine rankings and drive more traffic to their websites.

SEO Services Offered

You should also evaluate the services/offerings the agency has. It’s not just about what they do, but how they do it. Here are some tips:

- Proven Process and Customized Approach: Look for an agency that employs a proven process and principles for website audits and SEO, but also applies a customized approach tailored to your unique competitive position. This ensures that the agency is not using a cookie-cutter approach and is taking the time to understand your specific needs.

- Creativity and Innovation: A good SEO agency is highly creative and innovative. Ask the agency what unique strategies they have implemented to help their clients stand out from the competition. This will give you an idea of their level of creativity and innovation.

- Real World SEO Experience: Look for an insurance agency SEO services provider with at least 5 to 10 years of real-world experience. This ensures the agency has a better understanding of the competitive landscape and can deliver superior results.

Contract Duration and Flexibility

The way the agency deals with you can be a big indicator of its success (or failure). So to avoid getting stuck with a losing agency, consider the following:

- Look for an agency that offers flexible contract durations. You want to be able to adjust your SEO strategy as needed without being locked into a long-term contract.

- Communication and Transparency: Look for an agency that values communication and transparency. They should be willing to provide regular updates on the progress of your SEO campaign and be transparent about their strategies and tactics.

Need an SEO Strategist to Set up the Plan and Answer All the Pressing Questions?

If you’re feeling overwhelmed by what it takes to create content and improve your site’s SEO, it may be time to consider outsourcing to an SEO consultant. With their knowledge of the insurance industry and expertise in SEO strategies, they can help you develop a solid plan and ensure that everything goes smoothly.

Outranking’s SEO consultant and strategist can assist insurance agents and agencies with strategy, planning, and execution. This way, we help you get the right results. By hiring an SEO consultant, you can feel confident you’re making the most of your marketing efforts and attracting more leads.

With our help, you can focus on other business-building strategies, such as partnering with a lead connection service like EverQuote. So, if you’re ready to take your SEO to the next level, contact Outranking today.