- Product

- SEO Content Editor

- SEO Content Strategy

- Content Optimization

- Content Briefs

- AI Assisted Writing

- Keywords Clustering

Preview a demo walkthrough

Outranking the competition with our cutting-edge SEO strategies.

- Pricing

- Resources

- Sign In

- Get Started

Table of Contents

In the US alone, it’s expected that 30,500 new financial advisors will enter the industry by 2031. Over-saturation and extreme competition makes it difficult to stand-out. But with implementation of SEO best practices, the act standing out comes with its insane rewards. With the evolution of digital marketing, search engine optimization (SEO) has emerged as a crucial strategy for improving online visibility and increasing organic traffic to your website. If you want to stand above all the crowd of financial advisors, now is the time to focus on your site SEO and build a powerful SEO content strategy.

This guide will walk you through the steps needed to build a unique SEO strategy for your financial firm and provides useful tips to boost your website’s rankings and make you a search algorithm’s favorite!

Table of Contents

Why is SEO Important for Financial Advisors?

SEO involves optimizing your website and online content to rank higher in search engine results pages (SERPs) when relevant keywords are searched. Your financial firm can benefit greatly from a comprehensive SEO strategy through:

- Increased Online Visibility

- Improved Online Presence

- Increased Organic Traffic

- Better Client Acquisition

- Cost-Effective Strategy

- Measurable Results

How to Implement SEO for a Financial Advisor’s Website

Step 1: Construct A Website Architecture That Complements Your Core Service Areas

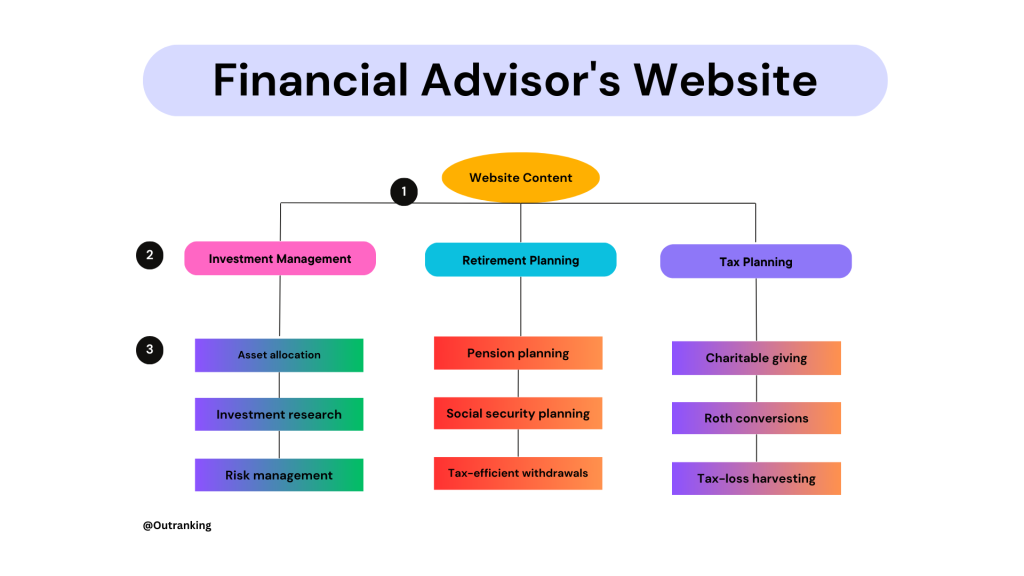

The first step to implementing better SEO for your financial advisory firm is understanding the core areas of the business. This involves identifying the key services offered by the firm and breaking them down into specific areas that connect with the core offering. By doing this, you can develop a targeted keyword strategy that aligns with your business goals.

To break down your website’s architecture into core offerings and its extended list of sub-areas, start by identifying its primary services. For example, a financial advisory firm may offer services such as “investment management”, “retirement planning”, and “tax planning”. Then, these services can be broken down into specific areas that connect with your core offering.

Here’s an example of potential core service areas and subareas that may apply to your financial advisory firm:

| Core Service Areas | Extended List of Sub-Areas |

| Investment Management | 1. Portfolio management 2. Asset allocation 3. Risk management 4. Investment research 5. Performance reporting |

| Retirement Planning | 1. Retirement income planning 2. Social security planning 3. Pension planning 4. IRA and 401(k) rollovers 5. Tax-efficient withdrawals |

| Tax Planning | 1. Tax-efficient investing 2. Tax-loss harvesting 3. Charitable giving 4. Estate tax planning 5. Roth conversions |

| Estate Planning | 1. Wills and trusts 2. Power of attorney 3. Beneficiary designations 4. Estate tax planning 5. Legacy planning |

By breaking down your services into specific areas, you can develop a targeted keyword strategy that aligns with your financial firm’s business goals. If the firm wants to focus on retirement planning, for instance, you can develop content around specific sub-areas such as retirement income planning and social security planning. This will help the firm rank higher in search engine results for relevant keywords and attract more targeted traffic.

By breaking down the firm’s services into specific areas, you can develop a targeted keyword strategy that aligns with its business goals. This will help SEO searches to show your website title or its homepage on SERPs.

Step 2: Conduct Keyword Research For Your Firm’s Core Service Areas

The keyword research process for your financial firm’s website can be simplified into three easy steps:

- Gather the list of keywords in each of the core areas of your firm’s website.

- If you have multiple core areas or sub-areas of focus, repeat the keyword research step for each one.

- Use a keyword research tool that you’re comfortable with and that gives you the data you need, like Semrush and Outranking.

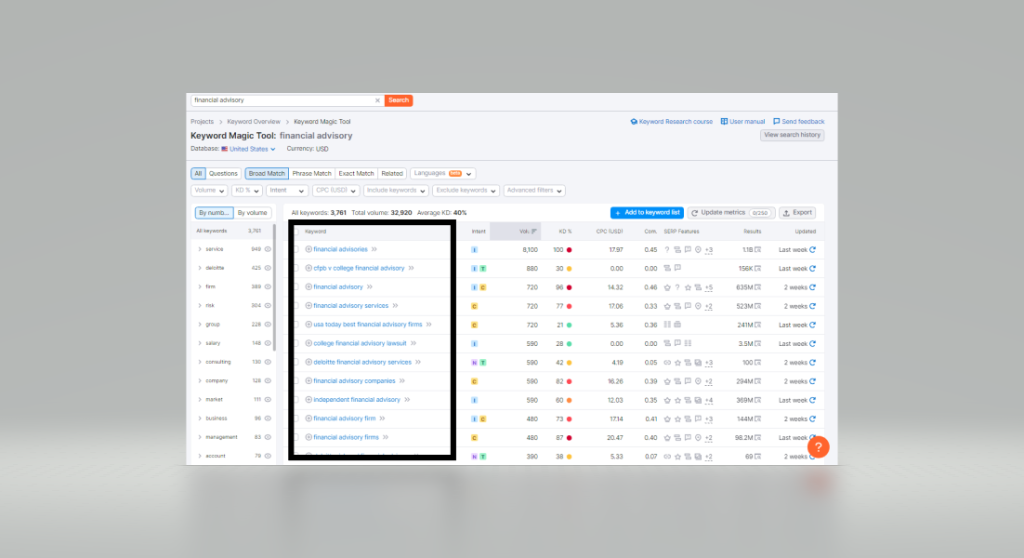

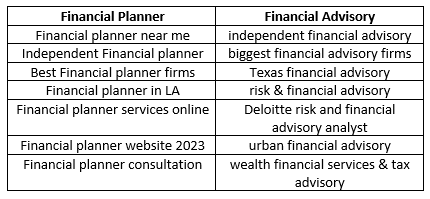

Method 1: Semrush

- Go to the Semrush website and log in to your account.

- Click on the “Keyword Magic Tool” option.

- Enter “financial advisory” or “financial planner” as the keyword in the keyword research tool.

4. Exclude any irrelevant or outdated keywords using the “exclude keywords” option.

5. Download the CSV file with the selected keywords.

6. Repeat this step for each core service area and sub-group.

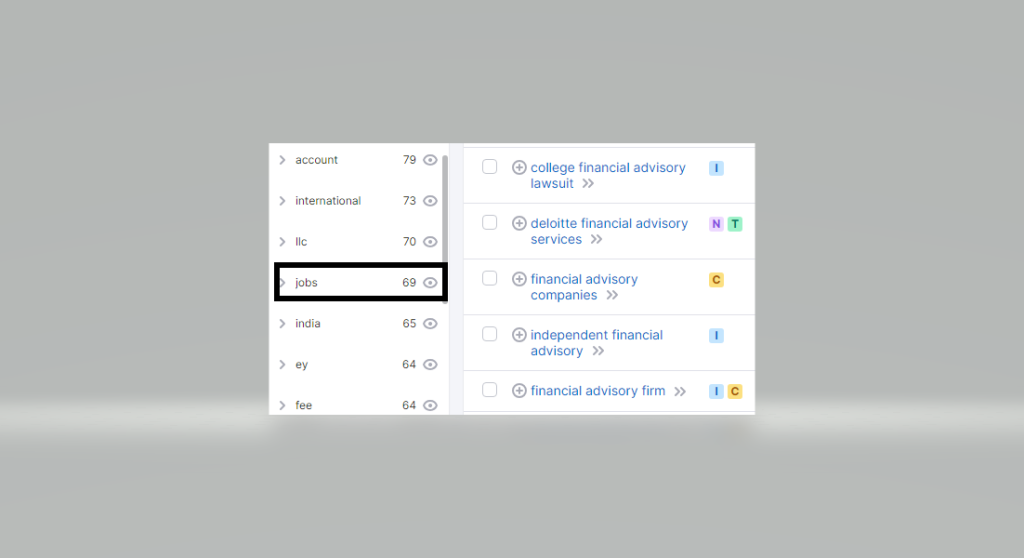

Method 2: Outranking

- Go to the Outranking website and log in to your account.

- Click on the “Keyword Generator” option and enter “financial advisory” or “financial planner” as the keyword.

- Outranking will automatically take you to the next step of keyword refinement.

- Use the streamlined cluster analysis option to avoid any extra hassle.

- Repeat this step for each core service area and sub-group.

Once the keywords for each sub-group in a core service area are collected, the next step is to move on to keyword analysis. This will involve analyzing each keyword in the file to build a content strategy that will help improve the firm’s website’s search engine rankings and attract more visitors.

Step 3: Create Keyword Clusters And Craft Content Around Them

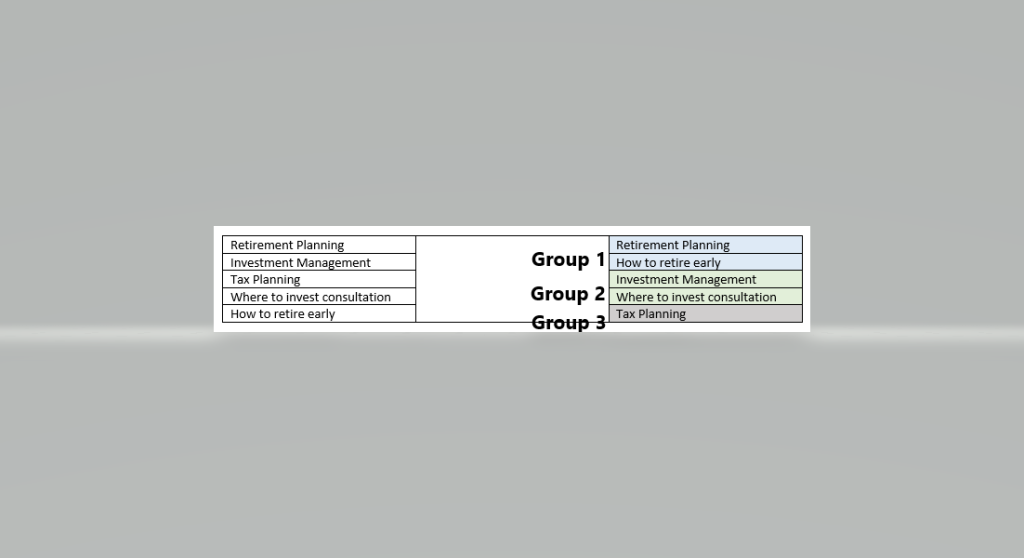

Keyword clustering is a technique that groups similar keywords together based on their semantic meaning and intent. By clustering keywords, you can create a targeted content strategy that aligns with your audience’s search behavior and improve your website’s search engine ranking.

For instance, you may have a list of keywords like “retirement planning”, “investment management”, “tax planning”, and “wealth management”. By clustering these keywords, the financial planner can identify related keywords and group them into clusters such as “retirement planning”, “investment management”, and “tax planning”.

To pick a primary keyword for each group of clusters, consider several factors such as competition in the financial advisory industry, keyword difficulty, backlinks, knowledge gaps, and topical authority.

With financial advising in such high demand these days, we understand you may not have the time to dedicate to crafting a perfect SEO plan – and that’s okay! It’s important to hire someone who knows what they’re doing if you don’t have an in-house SEO or marketing team because keyword clustering requires expertise and experience.

Tools like Outranking can make keyword clustering easier because it streamlines the process and provides accurate data.

Whatever you choose, keyword clustering is a powerful technique that can help your financial advisory firm create a targeted content strategy and improve your website’s search engine ranking.

Step 4: Prioritize Your Financial Advisory Firm’s SEO Efforts

Once your list of primary keywords and groups has been created, Outranking can help with prioritization by providing a priority-setting feature. This feature allows users to set priorities for keywords based on their importance and relevance to your firm.

Think of it this way:

| Priority | Keywords Containing | Why |

| High | Retirement planning, Investment management, Wealth management | These keywords are crucial for financial advisors and planners as they define their expertise and can support important pages for the flow of information. |

| Medium | Financial planning, Tax planning, Estate planning | These keywords can place the firm among many competitors and attract potential clients. |

| Low | Budgeting, Saving tips, Debt management | These keywords can define the firm as a thought leader and support important pages for the flow of information. |

By prioritizing keywords like this, you can ensure that your content focuses on the most important and relevant topics for your financial firm’s website.

Step 5: Set Up A Content Production Process

As a financial advisor looking to implement SEO on your website, it’s important to establish a content production process in place to ensure the success of your strategy.

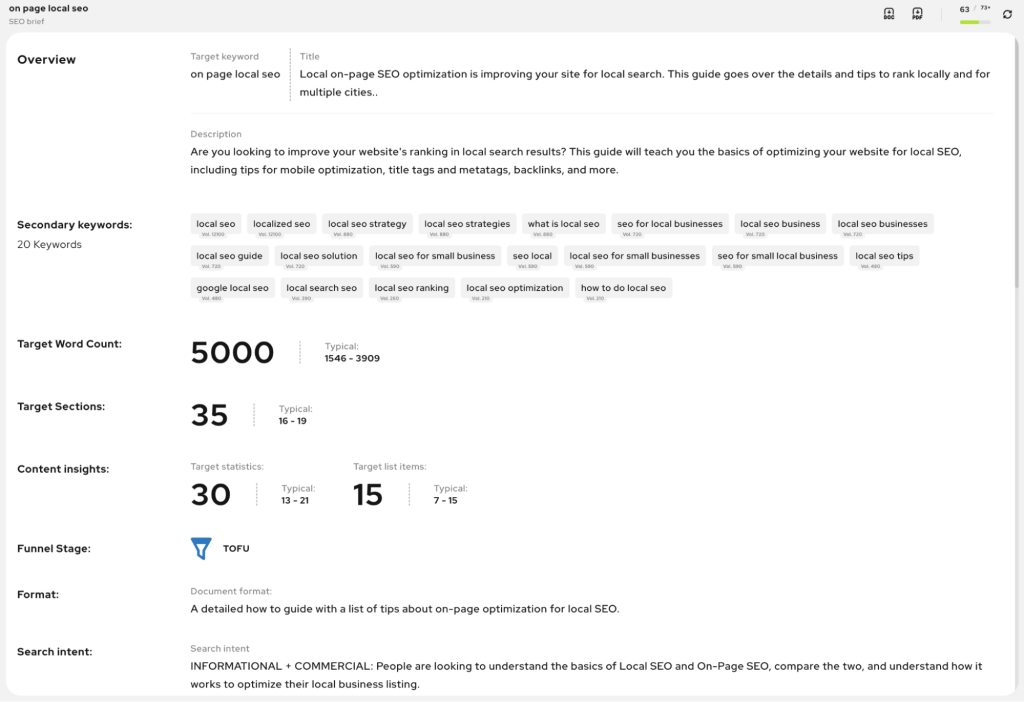

1. Create Solid Content Briefs

Before creating any content, have a clear understanding of what you want to achieve with it. Write a detailed SEO content brief that outlines the purpose of the content, the target audience, the keywords to be used, and the desired outcome.

2. Set up a Workflow for the Tasks

It’s important to have an optimal workflow in place to ensure that everyone involved in the content creation process for your firm’s website knows what they need to do and when. You can also use Outranking’s workflow status page to keep track of every document with a customized workflow.

With Outranking’s predefined workflow status and Kanban view, you can easily see what stage your documents are in and create content using their integrated tool to either build content briefs or create content directly in your SEO content strategy. This will help you have a complete content plan for the next six months and ensure that your strategy is executed successfully.

If you’re a busy professional who may not have a lot of time to do this all by yourself, consider hiring an expert agency like Outranking to help you make this plan come to fruition for your financial firm.

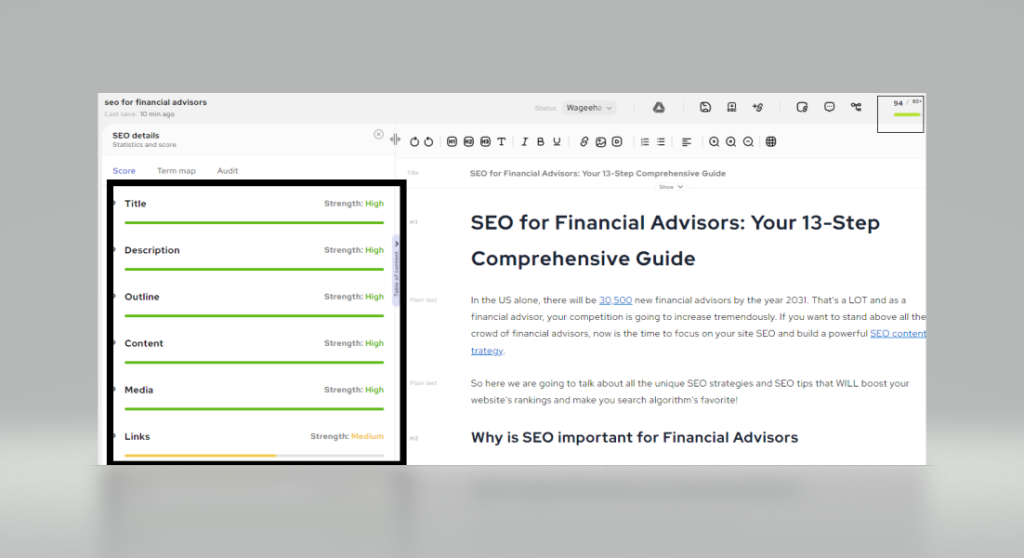

Step 6: Create SEO-Optimized Content

Creating SEO-optimized content for each service page and blog is crucial for financial advisory or financial planning businesses to ensure that they are spending their money on content that will yield results. By optimizing your content, they can improve your firm website’s search engine rankings, attract more organic traffic, and ultimately increase your firm’s visibility and credibility. However, for busy financial professionals with limited time, creating and optimizing content can be challenging.

This is where Outranking’s SEO content optimization and writing platform can help. With Outranking’s advanced features and real-time SEO scoring and on-page SEO optimization capabilities, financial professionals like yourself can save time and ensure that their content is optimized for the highest possible organic exposure.

You can learn about Outranking’s top features from the following video:

Step 7: Optimize Your Internal Linking

Optimize existing pages of your financial firm’s website with better internal linking for the overall traffic by borrowing the authority of pages that are already ranking and transferring some of that authority to the page you want to rank for more keywords. By analyzing the positions of existing pages and finding pages with keywords in the top 4-14 positions, you can find the perfect balance to get the most out of already ranking authorities.

For a financial advisory website, it would be beneficial to optimize pages that are ranking for keywords related to financial planning, retirement planning, investment strategies, and tax planning. These pages should have a lot of light and dark green, indicating that they are ranking between 1 and 10.

Outranking can connect to Google Search Console and identify these pages by using the URLs inspection tool to check the indexing status of a page and see its search performance. Outranking can then show internal linking opportunities by analyzing the positions of existing pages and suggesting internal links from pages that are already ranking and have some authority. This can help improve the website’s overall traffic and ranking.

Step 8: Gather Backlinks and Local References

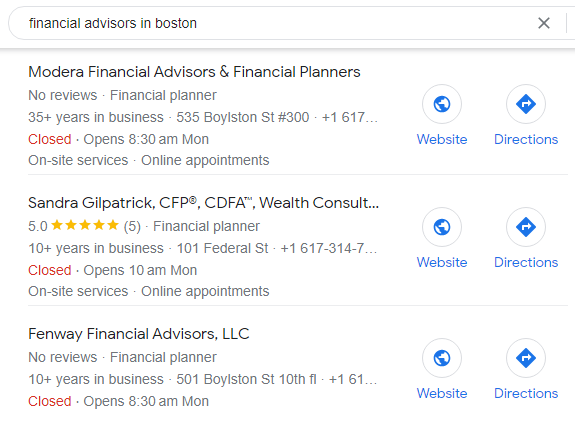

Citations are the fifth most important ranking metric for local queries. Local citations help search engines verify the existence, legitimacy, and trustworthiness of your business. Quality backlinks allow those users to land on your website without looking for your firm’s domain name. Focus on providing unique and valuable content to users in order to build backlinks.

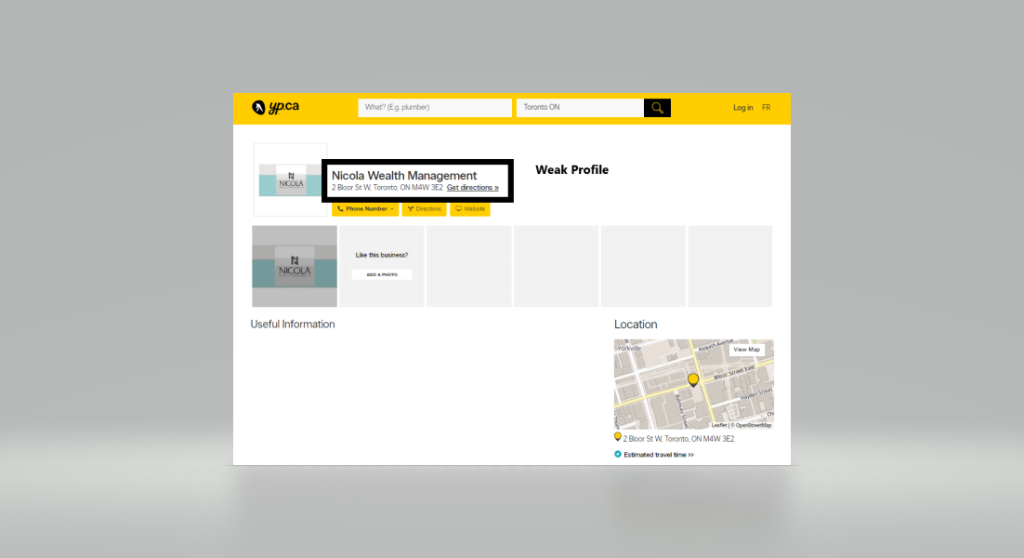

For financial planners, acquiring local citations can help with local SEO by increasing their visibility in local search results. It can also help establish their credibility and trustworthiness, which is important in the financial industry. There are two types of citations: structured and unstructured. Structured citations list the name, email address, and phone number (NAP) of a business, while unstructured citations are contextual mentions of a business.

Follow these four steps to build citations:

- Get listed with the ‘big three’ data aggregators: Acxiom, Data Axle, and Localeze. These data aggregators distribute business information to a wide range of directories and websites.

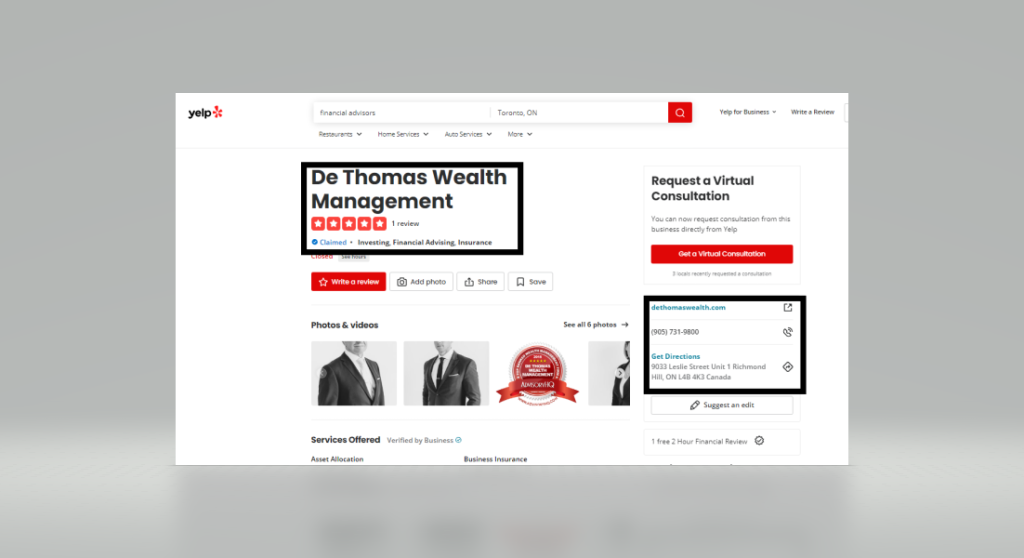

- Submit to other core sites such as Yelp, Yellow Pages, and Google My Business. These are popular business directory sites that dominate search results for local queries.

- Submit to popular industry and local sites such as the Financial Planning Association (FPA) and local chambers of commerce.

- Pursue unstructured citations by building relationships with local bloggers and journalists who may mention your firm in their content.

Here’s a table with a list of data aggregators and the websites financial planners should get citations:

| Data Aggregator | Websites to Get Citations |

| Acxiom | Yellow Pages, Citysearch, Superpages |

| Data Axle | Local.com, ExpressUpdate, Factual |

| Localeze | Bing, Yahoo, Yelp, Facebook |

Step 9: Optimize Page Speed and Website Experience

Optimizing page speed and website experience can help your firm’s website rank better in 2023. A slow website can lead to a higher bounce rate and lower conversion rates, ultimately affecting the financial success of your business.

To quickly optimize page speed and website experience, check out lighter themes such as the financial advisor theme on CodeCanyon, and NitroPack-like WordPress plugins. These tools can help reduce the size of images, minify CSS and JavaScript files, and optimize caching and compression settings. Optimizing your website for mobile devices also improves the user experience.

Step 10: Track Rankings Using Google Search Console

As a financial advisor, it’s crucial to connect to Google Search Console and track the rankings of your firm’s website because it can help you increase organic traffic to your website. By having a content plan and using the ranking data, you can optimize your existing content, uncover new opportunities, and improve underperforming pages of your firm’s website.

Use the following table to interpret the website ranking data and take appropriate actions:

| Goal | Ranking Data | Action |

| Optimize Internal Linking | Financial firm’s web pages with keywords in the top 4-14 positions | Improve internal linking structure to improve Pagerank |

| Build Topical Authority | Financial firm’s web pages with no ranking keywords in the top 20 positions that don’t align with the user’s search intent | Uncover new areas and ideas to create fresh content that can easily rank |

| Improve Underperforming Pages | Financial firm’s web pages with no ranking keywords in the top 20 positions that don’t align with the user’s search intent | Improve or redirect underperforming pages |

By following these steps, you can improve your SEO content strategy and attract more potential clients to your websites.

Step 11: Optimize Your Financial Advisor’s Local Google My Business Account

Google My Business is a free service that allows you to provide more information about your financial firm when it appears in search results. You can add photos, videos, business hours, telephone numbers, delivery areas, and links to reservation services, among other things.

Follow these practical steps to optimize your local search:

- Claim and verify your Google My Business listing: This is the first step to take to ensure that your business appears in Google search results. You can claim your listings by creating a Google account and filling out your business information.

- Optimize your business description and category: Ensure that your business description and category are accurate and relevant to your financial planning firm. For example, if your firm specializes in retirement planning, make sure that this is reflected in your description and category.

- Add high-quality photos and videos: Adding photos and videos of your financial planning firm can make it more appealing to potential clients. For example, you can add photos of your office, team, and events.

- Provide accurate business information: Ensure that your business information, such as your address, phone number, and business hours, is accurate and up-to-date.

- Encourage customer reviews: Encourage your clients to leave reviews on your Google My Business listing. Positive reviews can improve your local search ranking and attract more clients to your financial planning firm.

- Use Google Posts: Google Posts allows you to share updates, promotions, and events directly on your Google My Business listing. This can help you engage with potential clients and drive more traffic to your website.

- Monitor and respond to customer feedback: Regularly monitor your Google My Business listing for customer feedback and respond promptly to any negative reviews. This shows that you value your clients and are committed to providing excellent service.

Personalized examples for a financial planning firm listing could be adding photos of the team conducting a financial planning session, providing accurate business information such as the types of financial planning services offered, and using Google Posts to share updates on changes in the financial market or upcoming financial planning events.

While these steps can help optimize your Google My Business listing, it’s also highly recommended to hire a digital marketing agency to ensure that everything is done correctly and to maximize the benefits of local search optimization.

Step 12: Focus on the Ultimate goal: Leads and Conversions

Most websites focus on organic traffic because it’s a cost-effective way to drive traffic to their site without having to pay for advertising. However, focusing solely on traffic can be a mistake as it doesn’t necessarily translate into leads and conversions. For example, a short-tail keyword like “financial planning” may bring in a lot of unrelated traffic, whereas a more specific long-tail keyword like “retirement planning for small business owners” may bring in fewer visitors, but a more targeted audience for a financial planning firm.

It’s important to focus on leads and conversions because ultimately, the goal of your financial firm is and should be to generate business and revenue, not just traffic.

How to Evaluate an Agency to Help With the SEO of Your Financial Advisory Firm

Expertise, Reviews, and Results

When evaluating an agency to help with SEO for your financial advisor’s website, it’s important to look for expertise, reviews, and results. Here are some tips to help you make the right choice:

- Look for a proven process and customized approach: A good SEO agency will have a process in place that they can apply universally, but they will also tailor their approach to your specific niche. For example, at our firm, we perform industry analysis and competitive research to develop a unique strategy for each client.

- Creativity and innovation matter: The best SEO agencies are highly creative and innovative. Ask prospective firms what creative strategies they’ve implemented to help their clients stand out from the pack.

- Real-world SEO experience is key: Look for an agency with at least 5 to 10 years of real-world experience, preferably working with financial advisor websites. This will give them a better understanding of the competitive landscape and help them deliver superior results.

- Check reviews and results: Look for reviews and case studies to see what kind of results the agency has achieved for other financial advisors. For example, at our firm, we helped a financial advisor increase their organic traffic by 300% in just six months.

By following these tips, you can find an agency that will help your financial advisor’s website rank higher in search engine results and attract more clients. Remember to personalize the examples and response to your specific niche and keep it short and to the point.

SEO Services Offered

When evaluating an agency to help with the SEO of your financial planner’s website, consider:

- Proven Process and Customized Approach: Look for an agency that employs a proven process and principles that can be applied universally, but also applies a customized approach tailored to the unique competitive position of your financial planning business.

- Creativity and Innovation: A good SEO agency should be highly creative and innovative. Ask the agency what creative strategies they have implemented to help their clients stand out from the competition.

- Real-World SEO Experience: Experience matters in SEO, so look for an agency or an SEO expert with a minimum of 5 to 10 years of real-world experience, preferably working with websites in the financial planning niche. Beware of salesmen who promise the world to get you to sign on the dotted line.

For example, at XYZ SEO Agency, we have a proven process that includes industry analysis, competitive research, strategy design, implementation, and follow-up. We customize our approach for each client to help them achieve a sustainable competitive advantage within their niche. We also pride ourselves on our creativity and innovation, developing unique strategies to help our clients stand out from the competition. With over 10 years of experience in the financial planning niche, we understand the competitive landscape and can deliver superior SEO results.

In conclusion, when evaluating an agency for SEO services for your financial planner’s website, look for a proven process, creativity, and real-world experience in the financial planning niche. By choosing the right agency, you can improve your website’s visibility, attract more leads, and ultimately grow your business.

Contract Duration and Flexibility

When evaluating an agency to help with SEO for your financial advisor’s website, it’s important to consider contract durations and flexibility:

- Look for an agency that offers flexible contract durations. You don’t want to be locked into a long-term contract if you’re not seeing results. A good agency will offer month-to-month or quarterly contracts that allow you to adjust your strategy as needed.

- Ask about their approach to SEO for financial advisors. A good agency will have experience working with financial advisors and understand the unique challenges and opportunities in the industry. For example, they should be familiar with compliance regulations and able to optimize your website accordingly.

- Look for an agency that offers customized strategies. While there are universal principles and practices in SEO, a good agency will tailor their approach to your specific needs and goals. For example, they should be able to help you target specific keywords related to your services and location.

- Ask about their reporting and communication process. You want to work with an agency that provides regular updates on your website’s performance and is responsive to your questions and concerns.

For a financial advisor’s website, it’s important to work with an agency that understands the industry and can help you stand out from the competition. Look for an agency that offers flexible contract durations, customized strategies, and clear communication. For example, a good agency might offer a 3-month contract with the option to renew or adjust the strategy based on results. They might also provide regular reports on keyword rankings, website traffic, and lead generation. By working with an experienced and flexible agency, you can improve your website’s visibility and attract more potential clients.

Need Assistance? An SEO Strategist Can Help

If you’re a financial advisor looking to improve your search engine rankings and attract more business to your practice, it’s important to understand that effective SEO requires strategy and specialized expertise. While you may be able to learn the basics of SEO on your own, hiring an SEO consultant can help you create a solid plan and ensure that you have all the knowledge you need before hiring an agency.

Outranking’s SEO consultant and strategist can work with you to develop a customized SEO plan that aligns with your business goals and target audience. They can help you identify the keywords with buying intent that will attract the right visitors to your website and build trust with them through effective content and design.

In addition, an SEO consultant can guide you through the execution of your SEO plan, ensuring that everything goes smoothly and you get the right results. They can monitor your website’s performance and make adjustments as needed to ensure that you’re getting the most out of your SEO efforts.

Overall, hiring an SEO consultant can be a smart investment for financial advisors looking to improve their online visibility and attract more business. With the right strategy, planning, and execution, you can achieve higher search engine rankings and build trust with your target audience.